Jul 20, 2023

The CPA Exam: How to Prepare for New 2024 Requirements

When exploring the best path to prepare for the new 2024 CPA exam, look for graduate-level accounting degrees and certificates that incorporate the new requirements into their curricula.

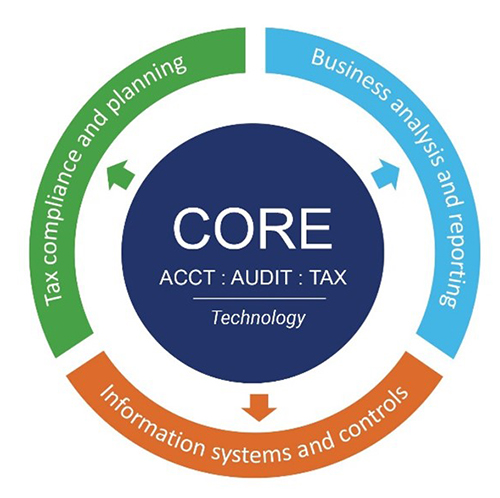

The CPA Evolution initiative impacts those who will sit for the exam after Dec. 31, 2023. The NASBA and AICPA determined three of the four core sections will remain the same:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

How will the CPA Exam change in 2024?

All CPA candidates must also show competency in emerging technologies and select one of these three new disciplines to demonstrate greater skills and knowledge:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

“Our profession is changing, and the updated licensure model reflects the more advanced skills and competencies required for entry-level CPAs. As a result, it’s important to look for a graduate accounting program that prepares you for these new requirements,” said Josh Herbold, associate head of the Department of Accountancy at Gies College of Business at the University of Illinois Urbana-Champaign.

How do I evaluate graduate accounting programs?

Look for a highly ranked accounting program known for its leadership in accounting education. Gies Business curricula prepares you to excel in addressing the evolving needs of the profession. These established programs are all designed to meet the increased demand for graduates who can turn data analysis into insights and apply the latest technologies to complex problems.

Gies is one of the first accountancy departments in the US to include data analytics into its curriculum, which is made possible by its close collaboration with The Grainger College of Engineering at the University of Illinois and other units on the Urbana-Champaign campus.

What new coursework will be available?

By Spring 2024, Gies will offer additional course content that includes assessments and refinements that specifically link to new accountancy standards covered on the new CPA exam:

• ACCY 405: Assurance and Attestation offers a broad overview of the profession and a student’s prospective place in it. Additional content will include tasks that link more specifically to accountancy standards covered on the new CPA exam.

• ACCY 312: Principles of Taxation and 451: Advanced Income Tax Problems includes assessments and refinements to teach tax planning, which is now more often part of a new CPA’s job.

• Gies will also add more coursework on government and nonprofit accounting, which is highly relevant, or specifically required, for CPA licensure outside the state of Illinois.

“Our innovative response to the effect data is having on the accounting industry makes our master’s programs stand apart,” said Gies Department of Accountancy Head Michael Donohoe. “Students can count on cutting-edge curriculum and high job placement rates.”

Which advanced degree path is right for me?

Gies Business offers three STEM-designated master’s in accounting programs that are designed to meet you wherever you are on your educational journey. You can count on cutting-edge curriculum and high job placement rates, regardless of which advanced degree you choose:

Master of Accounting Science (MAS) is a nine-month, on-campus program for those with a bachelor’s degree in accounting. Choose from Financial Reporting & Assurance or Taxation, then apply to specific concentrations, based on interests and career goals.

Master of Science in Accountancy (MSA) is a one-year on-campus program for domestic students who do not have a bachelor’s degree in accounting or international students with any bachelor’s degree. It is designed for those who intend to sit for the U.S. CPA exam or plan to pursue jobs as financial advisors, forensic accountants, consultants, and more.

Online Master of Science in Accountancy (iMSA) is a flexible, online degree program, tailored to working professionals who don’t want to uproot their lives to attend an on-campus program. Earn this degree in 18-60 months as a part-time student.

How do I earn CPA exam credit hours?

Gies Business offers four accounting graduate certificates to start earning the 120 semester credit hours you need to sit for the CPA exam in Illinois and the 150 hours required to become a licensed CPA in the state. Gain in-demand business skills with these stackable University of Illinois credentials:

Accounting Data Analytics teaches you how to synthesize and communicate data-intensive information, findings and conclusions, and develop the job-ready skills to solve accounting and business challenges.

Accounting Foundations is designed for beginning learners who want to build practical knowledge of accounting principles and learn industry-standard tools and techniques.

CPA Pathways prepares you for the CPA exam through curriculum focused on the technical knowledge and skills in financial accounting, taxation, and data analytics.

Taxation teaches you about the U.S. federal tax system, state and local incomes taxes, and the tax treatment and policies involved in doing business internationally.

Connect with Us

To learn more about how to apply for Gies College of Business advanced accountancy degrees and certificates, visit our website today.